Have you ever tried to purchase a multifamily property and found that the owner ran the business on the back of a cocktail napkin? How can you make heads or tails out of the financials well enough to ...

It was an absolute delight to have a conversation with Rubin Amon! He's my student who finally took the plunge and bought his first real estate property - and he hit a grand slam! Tune in to hear all ...

Tom Higgins is the Co-Founder and Managing Partner of Terra Capital. Tom has developed and renovated over 2,000 multifamily units throughout the United States. Tom and I discuss what to look for in a ...

Equity stripping is an asset protection method that involves transferring assets from one entity to another. This method can be used to shield certain assets from creditors and tax authorities, thereb...

Brenton is one of the top commercial real estate brokers in California. In today’s episode, we discuss his desire to switch to the multifamily space.

Listen to all our episodes and leave a review:...

I recently conducted a podcast with Public insurance adjuster Andy Gurczak. You can check it out here!

For those of you that don’t know, a public insurance adjuster can provide several benefits to a...

If you ever thought a podcast with a Polish public insurance adjuster would be a yawner, you are in for a treat. I had a lot of fun talking with Andy and giving personal firsthand knowledge of how imp...

Here’s the scenario. Everything’s on the way up. Prices. Occupancy. Rents. Investor Capital. All the right things are on the way down. Cap Rates. Expenses. Vacancies. Delinquencies. Multifamily invest...

Attention new and experienced multifamily investors, do you want to learn how to own 1,000 units in five years? If so, then this week's podcast is a must-listen!

Presented by Charles Dobens, Esq. Mu...

I was thrilled to speak with Ed Mathews on his podcast, Real Estate Underground. Ed and I discuss how to overcome inflation in multifamily investing.

Listen to all our episodes and leave a review:...

This is an interview I did with Peter Pomeroy on his podcast, Passive Income Through Multifamily Real Estate. Peter and I discuss how to be an investor, not a spectator.

Listen to all our episode...

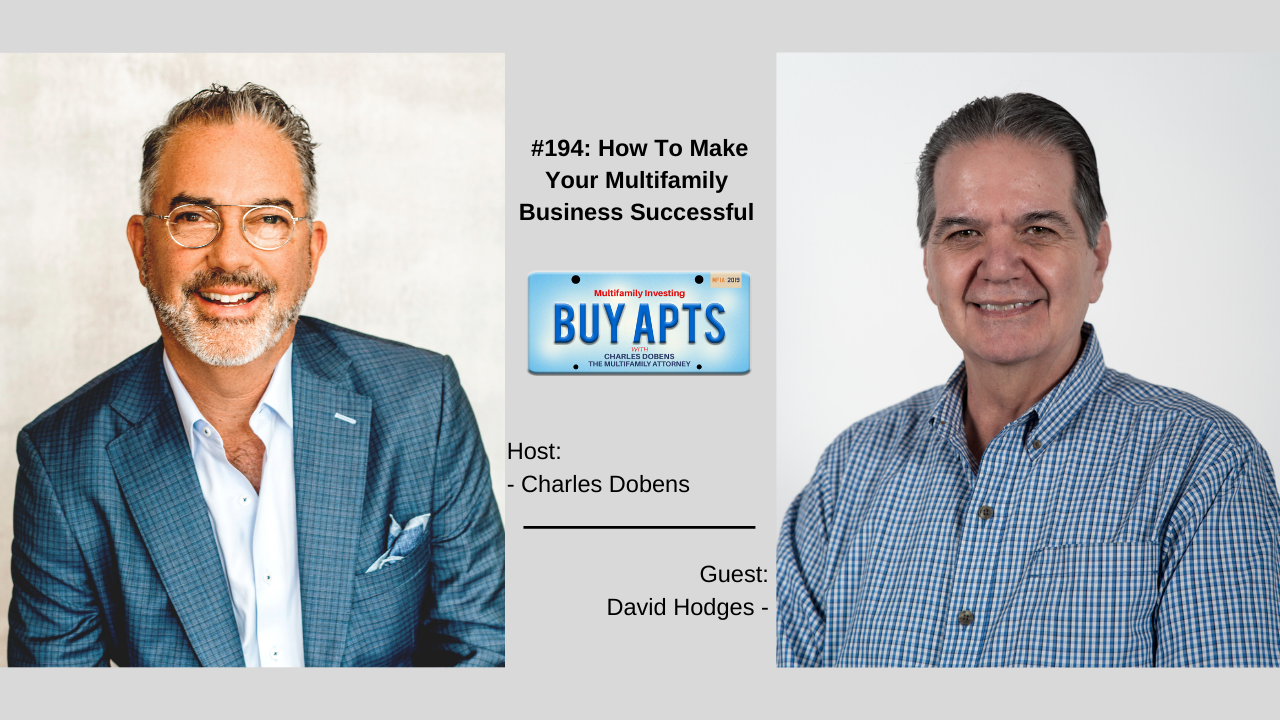

One of my successful clients, David Hodges also known as “The Million-Dollar Maintenance Man” walks you through how to make your multifamily business successful by teaching you how to increase your NO...

Never Miss a Thing!

Want expert multifamily investing advice straight to your inbox: stay up-to-date with the latest trends, regulations, and strategies by subscribing to our Newsletter! You’ll get exclusive insights from Multifamily Attorney Charles Dobens and other industry experts.

You're safe with me. I'll never spam you or sell your contact info.