Andrew is the Co-Founder and Managing Member of Four Peaks Capital Partners. He oversees the company’s acquisitions, asset management, and investor relations. He also co-directs the overall investment...

After 16 years as a firefighter and paramedic, Dave launched his career, rapidly becoming one of the nation’s top real estate investors. Within his first few years, Dave had transacted millions of dol...

Todd began his telecommunications career in 1989, working for such companies as Cablevision, US Xchange, and Charter Communications. Prior to joining MDU Consulting Group, he was the Director of MDU S...

Spencer and his company, Madison Investing, has co-sponsored deals totaling more than 5000 units for more than $600M. Spencer invests in syndications as an LP and actively leads Madison Investing alon...

Trevor is a High Performance - Master Coach with over 25,000 hours of coaching experience under his belt. He has worked with clients from around the world, including Fortune 500 executives, high-level...

Phillip Vincent has bought hundreds of houses and has a passion for working with families. He’s helping other families solve big problems by buying houses. While he started as a home builder and devel...

Ellis Hammond’s investing journey began when he was still

a full-time college pastor. With the goal to create passive cash flow for his family, he realized that investing in real estate could be an inc...

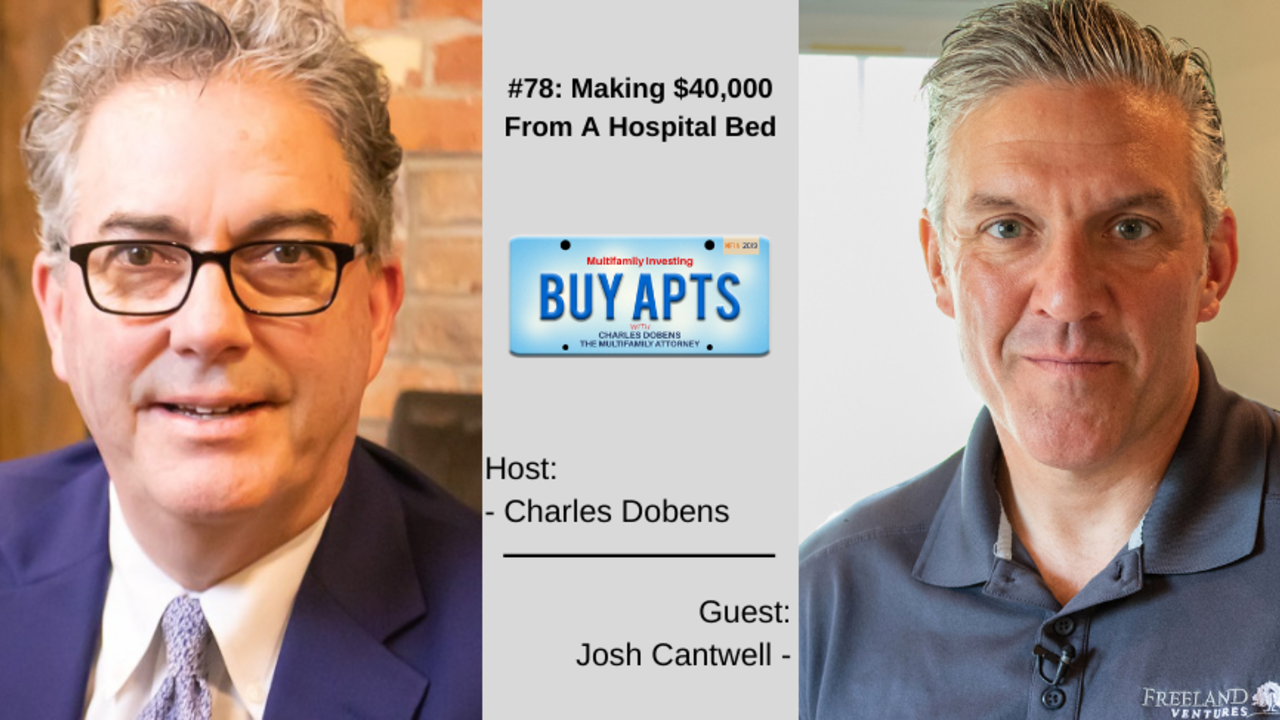

In 2004, Josh took his knowledge of raising capital and the financial markets and started investing in real estate full-time. He was able to combine his knowledge of financial investing with real esta...

Hunter Thompson is a full-time real estate investor and founder of Asym Capital, a private equity firm based out of Los Angeles, CA. Since founding Asym Capital, he has overseen and directed the purch...

Pancham is a host of The Gold Collar Investor podcast, full-time real estate syndicator, and principal of Mesos Capital. Pancham manages and controls over $32M in real estate. Pancham and I talk about...

Vanessa Peters, MD, is the founder of VMD Investing and has been investing in real estate for 12 years in single-family homes, commercial retail, apartment communities, short-term rentals, self-stora...

Jeff Lerman – Practicing attorney and, in my opinion, the expert and go-to-guy for Joint Venture Partnerships. If you are done doing the dance with the SEC and would like to put your deals together in...

Never Miss a Thing!

Want expert multifamily investing advice straight to your inbox: stay up-to-date with the latest trends, regulations, and strategies by subscribing to our Newsletter! You’ll get exclusive insights from Multifamily Attorney Charles Dobens and other industry experts.

You're safe with me. I'll never spam you or sell your contact info.